Consumer Packaged Goods (CPG) companies and retailers competing in highly fragmented markets tend to focus on pricing and trade promotions to boost sales. For these companies, deep discounts seem to be a popular route to the consumer's heart and shopping baskets. Often, trade promotion spends tend to be even bigger than advertising budgets.

However, many companies encounter a waning influence of deep discounts and other sales efforts and often get low-to-negative returns on their marketing spend. They struggle to get their pricing right, and often find that price drops are counterproductive. Trade promotions, sometimes, run aground because of a wrong choice of channels, or because they missed targeting the right set of audiences. According to Nielsen, more than two-thirds of trade promotions that happen in the US each year don't break even.*

Case Study

Co-creating an AI-led Marketing Mix Modeling Solution to Maximize ROI

Read More

So what's missing?

Clearly, creating optimized pricing and promotion strategies are challenging, especially in a digital world where omni-channel shoppers compare prices and deals. Top retailers and CPG companies, therefore, rely on analytics to get their pricing right. Some companies have even formed pricing sciences divisions in their organizations.

This focus on pricing is important as pricing is the only component of traditional marketing mix to have a direct impact on profitability.

In a highly fragmented market driven by digitally empowered consumers with wafer-thin brand loyalty, and nimble online competitors, pricing agility is the key to competitive advantage.

However, many companies struggle to make pricing decisions based on data, hampered by the lack of good quality data or the right capabilities — including the ability to understand the market context.

This point of view examines how companies can build strong pricing capabilities to achieve a positive impact on the bottom line and higher returns from marketing investments.

This write-up also highlights the imperative for customizable pricing solutions specific to markets and industry contexts instead of a one-size-fits-all approach. It describes pricing models as well as the key enablers for effective use of pricing analytics.

Data-enabled Pricing Approaches for Improved Profitability

Capturing Market Dynamics

Traditional approaches, such as temporary price reductions, are ineffective in a market where several dynamic factors influence consumer purchase decisions. For example, since consumers expect to find in-store stocks on the Internet too, a strategic mix of the right location and appropriate channels is needed for optimum pricing. Differential pricing across channels also influences demand. Further, competitor pricing — especially by pure play online retailers or e-tailers - needs to be considered in pricing decisions.

Would it make sense, for instance, to match a competitor on price, or offer a loyalty-based deal?

A product's position in the consumer basket and its price elasticity across channels also influence pricing. For retailers, the composition of the competitive shopping basket keeps changing as hundreds of stock keeping units (SKU) are introduced every year. Keeping track of the prices of these items, and constantly updating them, can itself be a massive challenge.

Given the complexity of the market dynamics, CPG companies need to consider acquiring specialized capabilities in order to get their pricing right. Leaders in the CPG industry usually have a pricing sciences division to help develop relevant pricing models.

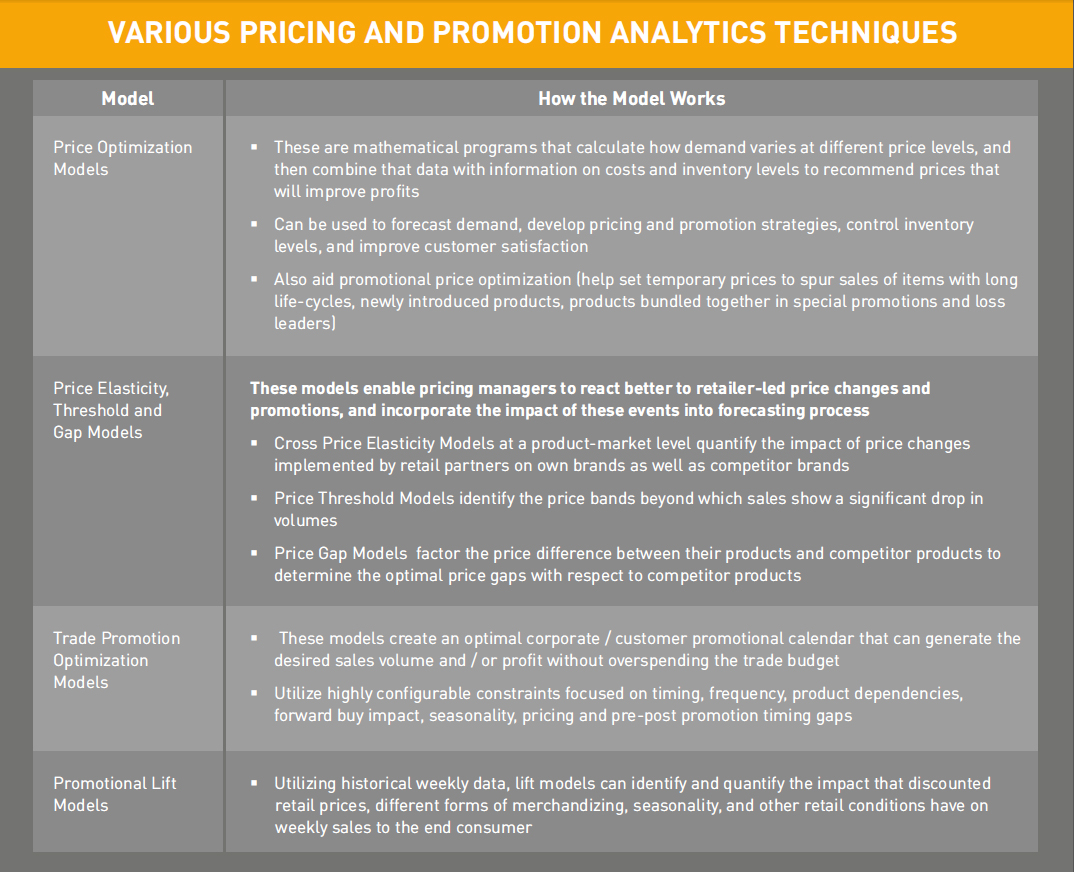

These models leverage analytical tools and techniques that take into account the multiplicity of influential factors in a constantly changing environment. Their use depends on the desired marketing or business goal. For example, price optimization models help forecast demand for different pricing and promotion strategies. This, in turn, helps control inventory levels and ultimately improve customer satisfaction by ensuring that the right products are in stock during promotions.

Analytics for Winning at the Point of Sale (POS)

Analytics is, therefore, the backbone of pricing management initiatives, and strategies for marketing and promotions. Analytics makes it possible to identify the most profitable customers, products or geographies, and appropriately target them in the most costeffective way.

Without analytics, companies tend to face a high risk of missing opportunities to improve profitability, margins, and market share. For example, with analytics techniques, marketers leveraging Temporary Price Reduction (TPR) campaigns can identify the inflection point beyond which any further price cut will mean negative returns. Marketers will also be able to assess pricing activities by their competitors, and identify those that warrant counter measures, thereby keeping marketing costs under control.

"5 Key Enablers to Enhance Marketing Impact with Pricing Analytics"

While top retail and CPG industry players have been the flag bearers of using analytics for pricing decisions, many companies actually get lower than expected returns on their marketing investments. The answer to leveraging analytics for better marketing impact lies in the groundwork. This involves five key enablers:

1.Deep Domain Knowledge

Analytical insights can be actionable only if they have been derived within the domain context – a fact that most companies tend to overlook. As each product category is unique, the market dynamics are also different for different categories.

Pricing, therefore, needs to be seen in the context of the consumer's relationship with the category. A 10 percent price discount on a car would exert a stronger influence on the consumer's purchase decision compared to a similar discount on a bottle of soda or a packet of chips. Sales promotions work better during festivals and holiday seasons for certain categories of products (for example, music albums and TV sets) than for others (say, laundry care products).

So timing of promotions, the purchase cycle of the consumer (for example, new cars are typically bought every three years whereas groceries are bought every month), and the market position of the brand – all need to be taken into consideration for pricing and promotion analytics.

2.Applicability of Data Sources

Informed decision-making implies the use of data. Every interaction with the consumer at various POS, and in social media and other online channels, produces huge amounts of information.

However, before mining this data, it is essential to understand the data sources, both internal and external, that can be used for relevant insights. POS data is a rich source of information, which needs to be examined carefully and harmonized before it can be used effectively for analytical insights. For instance, a global music company's unique codes for music albums and their multiple editions (singles, anniversary editions and so on) will generate POS data that cannot be used until it is harmonized. Similarly, a Quick Service Restaurant (QSR) chain with different POS classification systems in its company-owned and franchise-owned outlets would have two different sets of data that cannot be treated identically for analytics.

3.Robust and Comprehensive Modeling Capabilities

Disparate data sources as well as market and category contexts challenge a company's analytical maturity. A one-size-fits-all cannot produce analytical rigor. Companies should leverage statistically validated and robust modeling techniques for getting the desired business outcomes. The most frequently used techniques include multivariate linear model, multivariate log-linear model, multivariate log-linear model with Bayesian shrinkage property, and Hierarchical Bayesian model. These models help determine price elasticity, cross-price elasticity, and pricing corridors that can influence sales, direct marketing promotions, and other deals.

An organization's analytical capabilities are also dependent on building a strong and comprehensive talent pool of domain experts, data modelers, data miners, researchers, reporting and visualization experts.

4.Customize Analytics to fit the Market Context

For a quick market response, a scalable and standardized core solution framework is necessary. However, it is equally important to ensure that the framework allows flexibility to incorporate specific category needs as well. A product can provide scale, but it may only work within a certain operating model and market context.

Consider a Fortune 500 QSR with presence in many countries. Its standardized operations can allow the effective use of a tried and tested pricing analytics module. However, that does not imply that the same module will work for a large family-run QSR with a mix of franchisee and own store operations. The market and operational contexts of a family-run business will be different from that of the Fortune 500 QSR. Similarly, a model that is applicable for a beverage company looking for a competitive price advantage will not be appropriate for a music company that is focused on promoting its brand. The point to consider is that pricing solutions will depend on the marketer's goal, which varies from volume optimization to value optimization.

Given the complexity of building the right capabilities and the need for the right mix of product and customization, it would be useful to consider partnering with specialist providers of pricing sciences for customized and scalable solutions.

5.Socialize through Plug-and-Play

Picture this: A music company's marketing department is planning a price revision or a marketing event. It needs to take approvals from the CFO as well as the channel partners — all of whom would have their own inputs to offer. If the marketing function possesses a plug-and-play simulator to allow various stakeholders to test their hypothesis and check whether the model provides actionable insights, it would have a greater chance of receiving approvals from all stakeholders.

Organizations will find it useful to build such simulators for socializing the outcomes of pricing analytics among stakeholders who have their own insights into how a pricing decision would play out in the market. It provides a platform to safely test outcomes and reduces the risk of failure in the market.

Conclusion

Pricing and promotions based on data-driven insights will help CPG companies and retailers get better returns on marketing spend than solely relying on traditional marketing mix approaches. The right pricing strategies will prevent companies from blindly reacting to every price change made by competition and will create efficiency in trade promotions. As businesses expand, investments in analytics will support solutions for scaling up price transformation efforts.

Data for such decision-making is now more easily available than ever before. POS data itself can offer a wealth of information for CPG companies and retailers' marketing campaigns and pricing strategies. Along with access to the right sources of data, CPG marketers need a range of competencies — from domain knowledge (implying deep understanding of the context for price setting), modeling expertise, strategy, execution, and technology, for business process excellence. Companies need to ensure that these competencies are in place to fully exploit the power of analytics as a marketing tool.