The insurance industry stands at an interesting digital crossroad. According to McKinsey & Company,1 a study found an overwhelming 80 percent of insurers acknowledging the need for digital capabilities. Yet, 99.6 percent of those surveyed found it difficult to implement digital innovation. Rapidly emerging ‘InsurTech’ companies further add to the challenges that insurance companies face today.

As disruptive trends such as Artificial Intelligence (AI) and advanced analytics are re-defining risk assessment and policy underwriting in the insurance industry, business models are also undergoing radical shifts to empower smaller and niche players. Take for instance the AI-powered app developed by the startup Lemonade, a New York-based insurer for homeowners and renters. Instead of underwriters, algorithms help customers with quotes.2 The whole process of signing up and getting insured takes all of just 90 seconds. Filing claims is also simple with basic claims processed and paid in three minutes.

With customer engagement becoming crucial in the digitalization of the insurance industry, it’s imperative for insurers to invest in digital technologies and automation. It is estimated that the implementation of Robotic Process Automation (RPA) in claims operations can slash costs by 30 percent.3 Similarly, the deployment of RPA across the insurance contact center function can transform customer service operations, improve efficiency and enable cost savings.

Road to Fast & Simple Operations

Customers now want more personalized service than they can experience online. Contact centers can address this by leveraging faster, simpler, consistent and error-free technology interventions made available 24x7. North American insurance consumers rank speed of issue resolution as one of the most important requirements of customer experience. For companies, this needs to be achieved with a reduction in contact center operations’ costs for competitive advantage.

RPA provides all of these advantages. It can automate repetitive transactions in the areas of rates, quotes, issuance, underwriting, policy and claims administration. Mimicking humans in performing rule-based tasks and activities, software robots act as virtual agents to capture data from underlying systems and applications. They process transactions, manipulate data, trigger responses and communicate with other digital channels and systems with speed, consistency and efficiency.

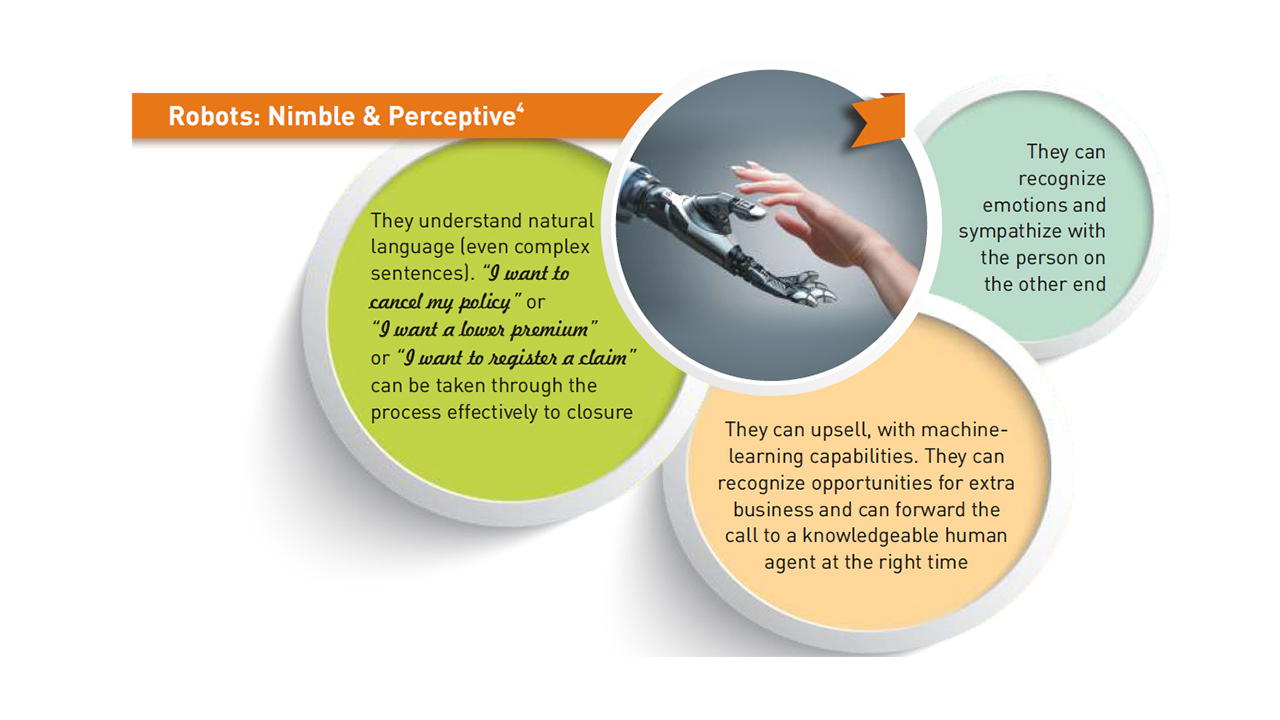

RPA integrates easily with existing legacy systems, is highly scalable and provides a faster implementation cycle. Mechanisms for auditing and governance can be automatically built in for remote and centralized monitoring. RPA can logically progress to machine-learning, natural language processing and deep learning to extract relevant insights from unstructured sources such as images and handwritten forms. Most importantly, it can identify, manage and build data repositories from the frustration points in a consumer’s digital experience. Thousands of daily customer interactions flow through the centers that can unravel valuable insights to enhance customer experience.

RPA can also enable insurance contact centers to gather customer information from all possible channels for seamless and unified customer service. For example, automation enabled a U.K.-based insurance company to identify customers adversely affected by floods, and design a waiver program for them.

Additionally, automation enables contact center agents to perform high-value activities instead of routine and repetitive tasks that cause fatigue. Agents spend around 30 to 40 percent of their time documenting transactions. RPA eliminates 80 percent of such documentation work.4

Key Impact Areas of Automation

Let’s take a look at some of the key areas where RPA can create an edge for insurance contact centers.

1. Customer Onboarding and Know Your Customer (KYC)

Customer information for insurance companies, as mandated by regulatory requirements, has to be provided across multiple channels. Background checks, identity verification, financial fraud and Anti-money Laundering (AML) checks, among others, require data to be entered into and extracted from different internal and external systems. Manual operations can be tedious, repetitive and error-prone. RPA can be deployed in a rule-based workflow to push and pull information into and from multiple systems. Add machine-learning and AI to the mix, and there’s a highly efficient and accurate outcome that also significantly enhances the customer experience.

2. Claims Registrations

The deployment of RPA can minimize human intervention in insurance claims registrations. Robots can pick up claims requests from an automated queue, validate customer details against policy details from internal systems, notify customers with claim request numbers and forward requests to the respective investigation teams. This saves time, effort and money besides improving customer satisfaction.

3. Claims Processing

When the First Notice of Loss (FNOL) notification comes in (and this can happen through multiple channels), contact center agents have to access multiple systems to create a claim. Various procedures have to be referred to and used for assessment and adjudication of claims, and prevention of fraudulent claims. RPA systems can automate the workflow for quicker and error-free claims processing.

4. Channel Management

Today, there are multiple business processes around an insurance company’s system of records. Customers apply for policies through multiple channels, and most policy administration systems are unable to efficiently extract and consolidate data from diverse sources. There are too many manual processes to capture comprehensive customer information.

RPA can mine information from all channels and integrate it into the policy administration system. A seamless handoff between human agents and robots can be designed for speedy issuance of new policies and address policy endorsements.

5. Underwriting

RPA can swiftly and accurately assess the risks of prospective clients by mapping their information database with set rules for efficient underwriting. Embedding AI-based algorithms and machine-learning techniques can elevate it to a more meticulous assessment than a mere rule-based workflow.

6. Core Back-office Operations

RPA technology can considerably enhance productivity in core back-office operations such as customer data updates, account reconciliation, check validation and overdraft protection.

7. Upselling and Crossselling

Robots can execute comprehensive and accurate product and service search in the sales process, extracting customer details from multiple applications, and consolidating them for agents to effect the right upsell and cross-sell possibilities. RPA can also complete the post-sale documentation in a fraction of the manual time and notify the customer with all relevant product details. Result? Higher sales and customer loyalty.

8. Audit, Risk and Compliance

RPA, in conjunction with machine-learning, can keep pace with dynamically changing audit and regulatory requirements. This ensures that insurance companies are continuously compliant and risk-proofed in the areas of data integrity, AML, fraud checks and risk reporting.

The ‘RPA-human’ handshake is a symbiotic one. RPA provides insurance contact center agents with insights to enhance the customer experience. It frees agents to use their intuitive and innovative skills (such as emotional intelligence, reasoning and judgment) to architect higher customer service excellence. The agent, on the other hand, teaches robots the complexity of human emotions that is absorbed through machine-learning.

Hence, contact center operations should be designed as a combination of automated solutions and intelligent manual support for complex and exceptional issues. Through an end-to-end value chain mapping, tasks can be identified for automation and re-engineering the customer service operations.

RPA thus becomes the insurance contact center’s digital employee that helps in the seamless navigation of business processes.

References:

-

http://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/intelligent-process-automation-theengine- at-the-core-of-the-next-generation-operating-model

-

http://www.mckinsey.com/industries/financial-services/our-insights/facing-digital-reality

-

https://www.mckinsey.com/business-functions/digital-mckinsey/our-insights/automation-at-scale-is-driving-transformative-change-across-insurance