For most of the preceding century, energy and utility firms operated on a relatively stable model. Demand grew predictably, infrastructure scaled gradually and reliability was delivered through engineering discipline and regulatory alignment. This model is now under visible strain.

In 2026, the sector is being re-shaped by a slew of new demand drivers and intensifying systemic pressures. Artificial Intelligence (AI)-driven data centers and electrification are compressing decades of load growth into a few short years, even as utility companies face tighter regulatory scrutiny, rising affordability concerns, aging assets, climate volatility and unprecedented customer expectations for reliability and service.

The result is a profound shift. Utilities are no longer just infrastructure managers; they are becoming real-time orchestrators of energy, data, capital and customer trust. Decisions made in 2026 will influence not only operational outcomes but the long-term resilience and relevance of these organizations over the coming decade.

These dynamics are converging, not unfolding independently. Together, they are re-defining the utility operating model – how demand is anticipated, how infrastructure is planned, how customers are engaged and how risk is addressed. The trends below highlight the most consequential shifts leaders must navigate to in 2026.

AI-driven Data Centers Are Re-defining Demand Planning

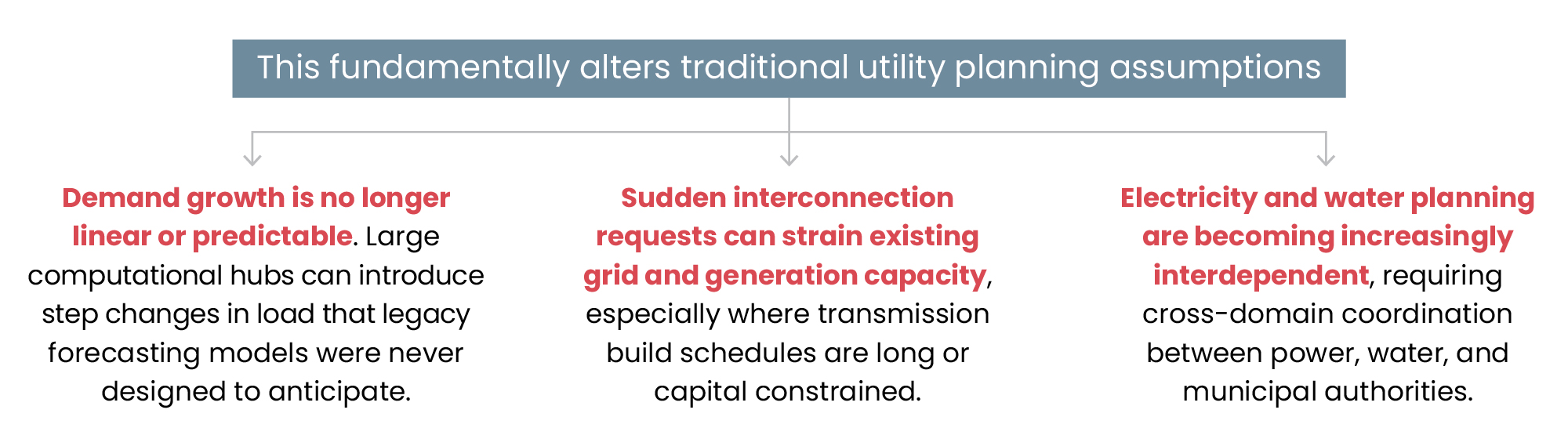

AI-driven data centers are expanding quickly and are now among the fastest-growing users of electricity and water worldwide. Data center electricity consumption is projected to more than double by 2030, to around 945 TWh,1 driven largely by AI workloads and hyperscale facilities. At the same time, water usage for cooling, particularly in high-performance AI facilities, is placing additional pressure on local water systems and environmental constraints.2

Strategic Implication

Utilities must move from static, long-range forecasts toward dynamic, scenario-driven planning models that incorporate digital infrastructure growth, cooling water constraints and energy transition pathways as core variables.

Embedded AI, Analytics, Cyber Resilience and Workforce Transformation Become Core Operations

AI is rapidly moving from experimentation to an embedded feature, driving operations and boosting agent productivity across the utility value chain.

Firms are scaling AI and digital technologies into mission-critical roles across grid operations, asset management, outage response and customer engagement. Predictive maintenance, real-time grid optimization, intelligent dispatch and automated service channels are becoming part of everyday operations rather than innovation pilots.

However, as digital systems become embedded, the risk profile changes as well. The expansion of connected platforms, cloud environments and AI-driven workflows significantly increases cyber and operational risk exposure across both Operational Technology (OT) and Information Technology (IT) environments. Cyber risk is no longer a technology issue alone; it is a business continuity, regulatory and public safety concern.

At the same time, utilities face a widening skills gap. An aging workforce, accelerating retirements and rapid digitization are creating shortages in analytics, cybersecurity, digital operations and distributed energy management capabilities.

Grid Modernization and Flexible Load Management Become Resilience Imperatives

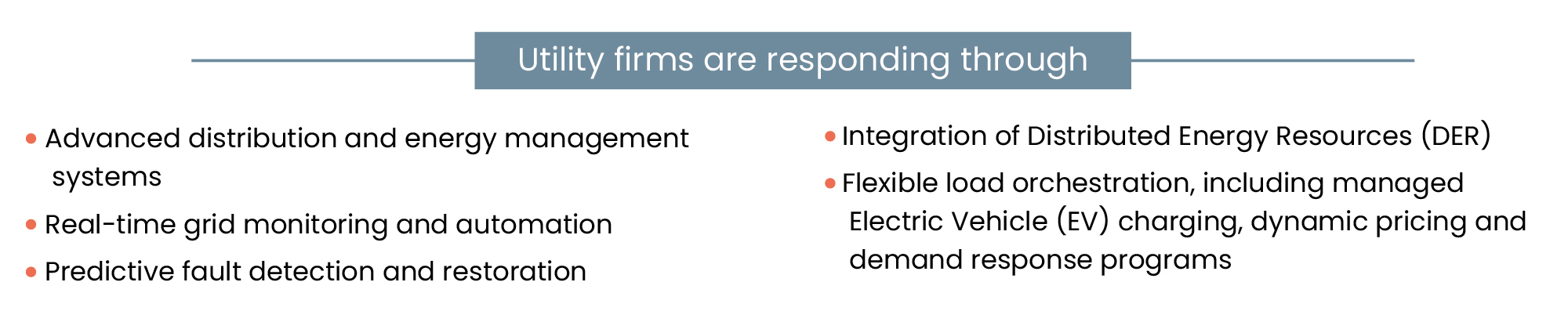

Electricity demand is rising faster than many utility companies planned for, driven by electrification, AI-related load growth and broader digital infrastructure.

Peak electricity demand in the US could grow by ~26 percent by 2035, placing increasing strain on generation, transmission and distribution systems.3 In the UK, electricity demand could roughly double by 2050 as heating, transport and industry decarbonize.4

As electrification accelerates, load itself is becoming a strategic asset. The ability to shape when, where and how electricity is consumed will increasingly determine system stability, capital efficiency and customer affordability.

Strategic Implication

Grid modernization must be evaluated not only for efficiency or compliance, but for resilience, flexibility and recovery capability in a system facing higher volatility and structural change.

Customer Expectations Are Re-defining Service and Trust

Customer expectations in the utilities sector are being shaped by experiences in digital-native industries and a growing sensitivity to affordability, reliability and transparency.

Customers increasingly expect their utilities provider to be proactive, personalized and transparent – not simply responsive. They want to be alerted to unusual usage patterns, informed about tariff changes, guided with timely insights during peak periods and proactively updated on outages and restoration timelines. The era of one-size-fits-all service is giving way to engagement that is relevant, timely, and contextual.

This shift is enabled by data from smart meters, digital channels and customer interaction histories – but it is driven by expectations, not technology. Customers want to feel informed, supported and in control of essential services that directly affect their daily lives and household finances.

At the same time, expectations now extend into fairness and access. Customers, regulators and communities increasingly evaluate utilities on how they support vulnerable populations, manage affordability and respond during moments of stress.

Increasingly, these interactions also influence utility firms’ sustainability goals – creating opportunities to educate and empower customers on how they can contribute to the energy transition through more efficient use of energy and water, guided by personalized insights and scarcity signals. This not only advances sustainability outcomes, but also supports operational objectives by shaping demand more effectively and reducing system stress.

Credit, Revenue and Affordability Management Become Strategic Capabilities

With rising tariffs, complex pricing structures and economic uncertainty, utility firms face increasing pressure on revenue assurance and customer affordability.

Advanced analytics enable early identification of accounts at risk, segmented and empathetic collections strategies, real-time billing transparency and improved recovery outcomes while maintaining customer relationships.

Strategic Implication

Revenue operations must shift from reactive collections to proactive financial engagement that balances financial sustainability with customer welfare and regulatory expectations.

Climate, Regulation and Strategic Procurement Shape Long-term Decisions

Climate risk, regulatory evolution and supply chain volatility are re-shaping capital planning and operating strategy.

Companies must navigate de-carbonization mandates, infrastructure hardening requirements, commodity price volatility, equipment shortages and long lead-time dependencies for critical assets such as transformers, substations and grid-scale storage.

At the same time, growing public and customer expectations around sustainability and resilience are reinforcing these pressures, increasing scrutiny on how firms balance environmental outcomes with affordability and service reliability.

Strategic Implication

Climate risk, regulatory compliance and supply chain strategy must be fully integrated into core financial and operational planning rather than treated as external constraints.

The Way Forward: A Structural Re-set, Not an Incremental Shift

The defining feature of 2026 will not be a single technological or regulatory factor, but the convergence of multiple disruptive forces unfolding simultaneously.

Demand is rising unpredictably, digital technologies are becoming operational muscle, customer expectations are rising and regulatory and climate pressures continue to intensify. In this environment, the utilities sector must undergo a holistic transformation, from asset-centric operators to adaptive, data-driven service organizations.

The firms that thrive will not be those that adopt technologies the fastest, but those that integrate strategy, operations, data, workforce and customer value into a coherent operating model for the decade ahead.

References

-

Executive summary - Energy and AI - Analysis - IEA

-

Impact of growth of data centres on energy consumption

-

2026 Energy Industry Outlook | Deloitte Insights

-

The Great Grid Upgrade | Powering The Things You Love