The Shipping and Logistics (S&L) industry is bogged down by a legacy of aging and inward-facing technology. This involves significant manual interactions, multiple unsynchronized versions of data and limited automation.

A study1 developed by maritime industry leaders, Navis and XVELA points to poor visibility and predictability, and insufficient data insights as the reason for S&L players losing money. Real-time access to relevant data was cited as critical to increasing efficiency.

However, while S&L companies' resistance to change and aging systems are holding them back, according to the report, the industry is at the tipping point of digitization. This can be attributed to the consolidation that has occurred in the industry since early 2016 which has seen the top 20 independent shipping lines reduce to 14.

The consolidation, while offering stability to the industry, has also created the perfect opportunity to re-think processes, digitize shared operations and implement collaborative technologies. It also paves the path to minimizing highly manual processes and intercompany communication.

Freight forwarders, in particular, are seeing increased disruption by digitized players who have the potential to squeeze them out of the market. They are being forced to change their business model and move either towards increased asset ownership or new value-added services.

The Perfect Digital Wave

The Perfect Digital Wave

The emergence of cloud platforms, collaboration and connectivity technologies, neutral digital networks (such as INTTRA), advanced analytics platforms, Internet of Things (IoT), Artificial Intelligence (AI) and machine-learning solutions have increased opportunities for S&L companies to embark on some level of digital transformation.

According to Roland Berger, the following are the key drivers of digitization in the shipping industry:

-

Increased competitive pressures

-

Evolving customer expectations

-

Regulatory changes

-

Disruptive digital technologies

In 2016, INTTRA noted that 27 percent of containers in the global ocean trade were processed digitally through their platform. In the same year, an encouraging change in the regulatory requirement of SOLAS Verified Gross Mass (VGM) provided an opportunity for S&L companies to break away from manual processes. E-VGM is the result of INTTRA’s initiative and collaboration with other industry groups for a digitized approach. This indicates that though approximately half of all bookings today are still manual, the industry can adopt incremental digitization strategies.

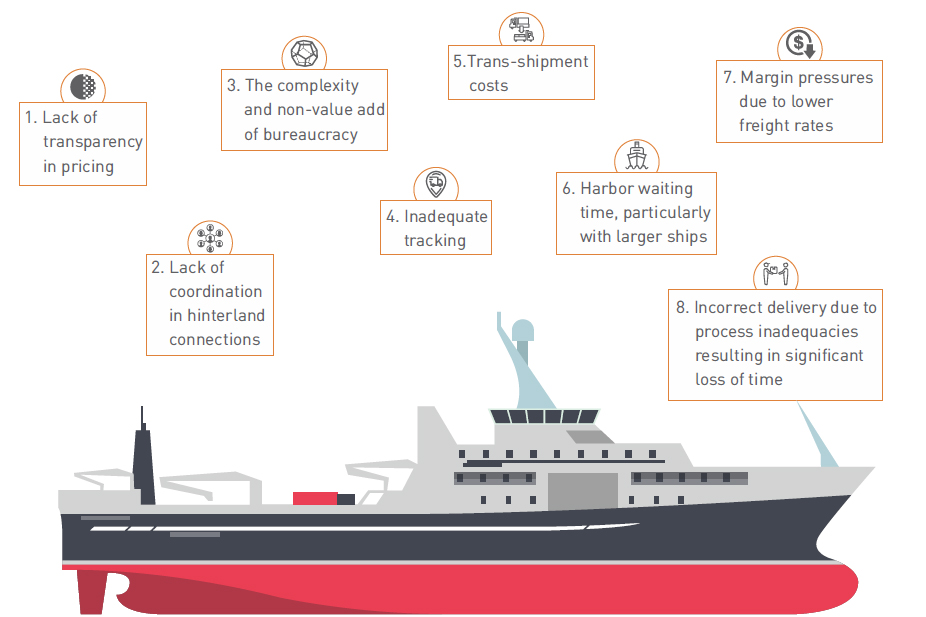

Roland Berger highlights eight pain points as given below in most shipping lines that will clearly benefit from digital transformation.

New digital strategies and business models to address these issues may be grouped into:

Customer-facing digitization that transforms experiences. For example, self-service web and mobile capabilities that use innovative content and design can enhance the user experience and prompt customers to return.

Internal-facing digitization that automates operations. Companies can eliminate manual interactions, redundant copies of data and associated synchronization. The application of algorithms, AI and machine-learning can further support operational, tactical and strategic decision-making, including smart capacity optimization.

Collaboration and connectivity with agents, ports, terminals and depots. Companies can leverage digital data for all third-party connectivity. Their collaboration can be underpinned with a communication layer designed to be embedded in the inter-entity business processes.

Digital transformation thus becomes a progressive endeavor to introduce new technology and processes in each of these areas, in turn or in parallel.

The fundamentals of adopting a digital transformation strategy call for a roadmap to becoming a digital business, and transformation blueprints for each individual shipping line. There’s a need for internal awareness and a change in organizational culture. Ultimately, digital transformation is all about digitally connecting entire operations, eliminating manual processes and paper management, and automating relevant areas where possible. Such a transformation can enable smart carriers to see an uptick in revenue growth and cost savings.

While both technology and digitization strategies are important, the deployment of analytics, automation and AI should be complemented by other measures2. Preparing and training the workforce will be an imperative. Customers should be brought onboard at the start of the transformation journey. Speed will be a critical element while new products should focus on enhancing the digital transformation.

Companies with industry expertise and strong capabilities in business transformation and process management can enable ocean carriers to achieve their digitization goals. Such partners can simultaneously focus on the digitization of both customer-facing and internal operations, including smart capacity optimization.

Strong partnerships and cloud-based analytical tools that leverage sophisticated monitoring and AI technologies will undoubtedly help the S&L industry with insights-led decisions to improve every segment of the shipment value cycle — from planning to operations to execution. Standardized processes, streamlined workflows, and analytical and automated efficiencies will create a seamless path to attain a future digital state. As the digital disruption slowly upends traditional business models, the shipping industry should move quickly to keep up with the tide.