The survival of investment management firms hinges upon the strong performance of the fund products in their portfolio. In today's global economic climate, Asset Management firms are looking to spread the risk and at the same time receive top marks from independent ratings agencies for delivering above-average returns to their clients. Set against a background of market volatility and increasing regulatory scrutiny, successful investment management companies are those that can consistently make the shrewdest bets on equities, property, bonds and alternative products.

The Traditional Formula: Investing in Internal Resources

The quintessential dilemma confronting research desks in investment management firms is to balance the surfeit of information with sufficient analysis. Equity research, which is company-specific, can never claim to be an end in itself. Changing times require a sharper focus and analysis around areas such as supply chain efficiency, market dynamics, risk governance, government regulation, customer satisfaction and loyalty, corporate and social responsibility, and diversity policies. The traditional focus on quantitative data focused on companies needs to be blended with qualitative analysis on industries, governments and countries.

From an external context, it is absolutely essential that there is a thorough and accurate assessment of the ever-rising ocean of data – that of markets, competition, threats and opportunities. What most firms lack is the ability to filter, cross-reference and analyze this sea of knowledge. An investment management firm has to take a 360 degree view of the ramifications of new technology, the Internet's potential for disruption and disintermediation, shorter time-to-market cycles, threats from both consolidation and new entrants, globalization and outsourcing. First-mover advantage by investment managers is important for minimizing risk and maximizing potential return. More than ever before, it is knowledge available at the desktop, which can be the key differentiator to complement the largely recycled conventional wisdom of industry experts on the airwaves. For example, online reputation monitoring (sentiment analysis) is emerging as an important early warning indicator of whether a market, entity or government is moving in the right direction. The fastgrowing universe of secondary research can complement other forms of intelligence on the viability of publicly listed companies, markets, governments and property markets.

Internally, these firms make daily fund decisions on the appropriate mix of equities, fixed income and alternative investments in their portfolio. Most asset management firms are paranoid, and rightly so, about what is being said about their company, products, funds and performance in the public domain. Here again, the secondary research desk inside investment management firms can systematically capture this knowledge and positively impact the marketing and communication strategies of their brand.

Aligning with the Shifting Paradigm

After the pummeling of recent years, the impending upturn will be viewed with caution. Investment management companies that culled their analyst layers in the recession will tend to re-build at a slower rate than the markets they survey. Research analysts who held their jobs in the downturn will be in high demand as the market rebounds – in fact, this is traditionally not just limited to the poaching of star analysts but extends to the hiring of entire fund teams from rival firms!

With transparency becoming the new world order, investment management firms need to look for strategic alternatives to stay competitive and compliant. More rigorous and structured competitor benchmarking will be vital.

Clearly, these firms must look at smarter ways of managing their knowledge assets as they seek to accelerate their response to market changes. They must retain their flexibility, enhance analyst-to-coverage ratio, and yet ensure that there is no impact on the quality and depth of research that underpins decision-making. And, of course, all this must be done cost-effectively.

Outsourcing – Analyzing for the Fund Management Analyst

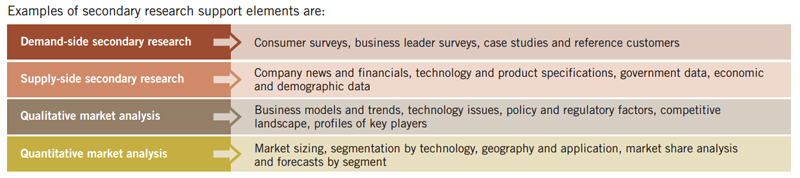

Outsourcing investment research activities to multi-skilled professionals, capable of generating insights on all elements at play in the market, has emerged as a smart alternative to meeting the challenges faced by investment management firms. Highly educated teams of desktop researchers help monitor trends, opportunities, threats, market-shifts and competitive moves. More importantly, they draw out implications for an investment management firm's strategic direction, product portfolio, brand and evolution.

The benefits that an outsourced secondary research function can provide to an investment management firm include:

- Providing a hub to cross-reference, contextualize and make recommendations derived from company-specific research (equity research), syndicated market research (for example, Gartner Group), licensed data sets (for example, Hoovers, Factiva) and online business intelligence.

- Providing information on niche or emerging markets, which generally lack syndicated research coverage.

- Investment firms need better prospect intelligence. For example, which investor market segments match their product portfolio sweet spots. Immediate analysis is often needed on whether merger and acquisition opportunities align with internally developed buying criteria. An outsourced provider could be the perfect partner to dive into the depths of data at sundown and surface with relevant analysis by sunrise.

- Secondary research is also paramount for analyzing the information on a company from every spoke connecting to the hub. This implies analyzing the industry-specific information alongside company-specific. It is also rare that a single data source is robust enough to be accepted at face value. Secondary research enables sanity checking of a constellation of assumptions and forecasts to empower decision-making. Such analysis can add a valuable dimension to better second-guessing the market in the ongoing contest between a company's 'expected earnings' versus 'analyst estimates'.

William Shakespeare once asked, 'What's in a name?' The answer for investment management firms is 'everything'. If the latest Wall Street movie is titled 'Money Never Sleeps', the same is true for the exponentially growing universe of data, which underpins critical external and internal decisions for an investment management firm. And herein lies the potential for these firms to stay ahead of competition by partnering with a third-party provider who can bring the advantages of cost, scale and expertise to analyze that universe!