Can a 100-year-old company rewire its supply chain to stay competitive in the digital age? Driscoll’s, market leader in the U.S. fresh berry market, has done exactly that. Driven by its mission to deliver ‘Only the Finest BerriesTM, the company had launched its technology-backed Delight Platform in 2012. The platform uses Internet of Things (IoT)-led sensors, data warehouses and proprietary analytics to monitor and maintain the quality of berries across the supply chain.1

Today, Driscoll’s is integrating Artificial Intelligence (AI), machine learning and blockchain into its supply chain to digitize it further.2 In a market where 93 percent customers favor freshness over quality,3 the company’s digitized supply chain ensures that over a billion pounds of farm-fresh berries reach customers.4 This transformation of a company’s traditional supply chain is indicative of digitization’s expanding role in remolding the logistics industry from the ground up.

Read what will define Shipping & Logistics in 2025

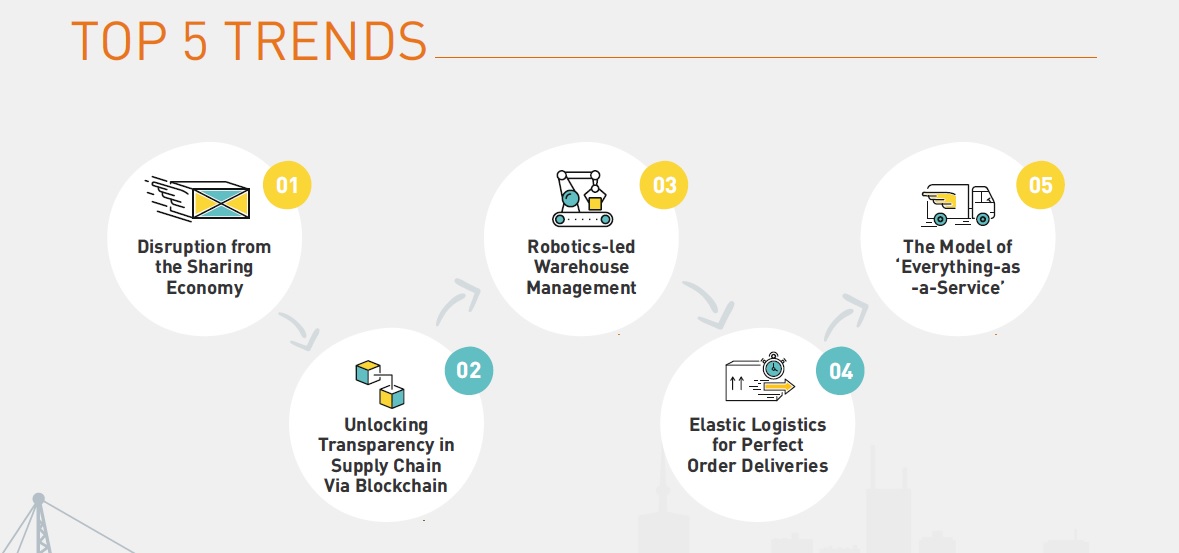

Here are a few other key trends, underpinned by disruptive technologies, that are reshaping the Shipping and Logistics (S&L) industry.

1. Disruption from the Sharing Economy

1. Disruption from the Sharing Economy

The global sharing economy is expected to reach USD 335 Billion by 2025.5 Having already disrupted asset-heavy industries such as hospitality (Airbnb) and mobility (Uber), the on-demand economy will now disrupt the S&L industry.

The timing is right for the strategic shift in S&L providers’ operating models. The digitally savvy customer is placing unprecedented demands on the supply chain. For example, there’s a substantial surge in the number of customers expecting same-day deliveries of their online purchases. The value of merchandise delivered on the same day in the U.S is projected to reach USD 4.03 Billion in 2018.6

In order to fulfill such evolving customer requirements, collaboration in the S&L industry will be redrawn by Uber-style approaches, last-mile delivery alliances and corporate partnerships. Self-learning algorithms will be used to identify enroute collect and drop-off opportunities for agile deliveries in the shared economy.

The pan-European interconnected platform Cargostream is already enabling on-demand supply chain collaboration. The platform allows shippers to bundle their transportation needs with other shippers.7 This model is delivering benefits such as reduction in empty miles and enabling multimodal transportation (shifting between road / rail / inland waterways) even for shippers who otherwise lack the scale.

2. Unlocking Transparency in Supply Chain Via Blockchain

2. Unlocking Transparency in Supply Chain Via Blockchain

Blockchain will introduce robust traceability in supply chain operations. It will realize cost savings by enabling automated, optimized and error-free processes. The movement of goods will be quicker due to more visibility and predictability in the supply chain.

Multiple stakeholders, transnational locations, and a multitude of invoices and payments often add to the complexities in the supply chain. There’s also a significant lack of transparency in the existing system – a barrier that limits trust. Tamper-proof, blockchain-led records spanning the entire supply chain will foster trust since all stakeholders will have access to a single source of truth.

Blockchain can help global companies tackle fraudulent trade as well. Global diamond company, De Beers Group, is setting up a first-of-its-kind blockchain ledger to track diamonds across the supply chain – right from the time they are mined till they are sold.8 This initiative is expected to guarantee ethical and conflict-free diamonds to be sold by the company.

3. Robotics-led Warehouse Management

3. Robotics-led Warehouse Management

By 2021, the global logistics and warehouse robot market is expected to reach USD 14.43 Billion.9 The demand for robotics will be driven by the exponential growth in e-commerce, the expanding Third-party Logistics (3PL) market and a shrinking labor pool.

Advanced robotics technologies are evolving backed by research funded by governments, venture capitalists and companies such as Amazon. These technologies will bring in a new generation of robots that will closely collaborate with humans to execute nuanced tasks. The deployment of robots in unloading and picking up containers, and home delivery, will boost efficiencies and productivity in warehouses, sorting centers and last-mile deliveries.

A number of startups have already entered the warehouse automation market with Autonomous Mobile Robotics (AMR) that combine embedded intelligence and application software. For example, Locus Robotics, a Massachusettsbased startup, has developed a multi-robot fulfillment system where scanned items autonomously navigate through the warehouse infrastructure. While driverless technology is still short of large-scale deployment, autonomous delivery options, including drone deliveries, will gain traction.

4. Elastic Logistics for Perfect Order Deliveries

4. Elastic Logistics for Perfect Order Deliveries

Organizations will respond to unpredictable fluctuations in customer demand through elastic supply chain strategies. Such elastic operations will allow demand-driven capacity planning supported by real-time visibility. Advanced analytics, IoT, machine learning and AI will enable supply chains to further stretch the limits of elasticity.

Supply chain designs and strategies will no longer solely focus on becoming lean. Fail-safe elasticity in managing demand will be the dominant approach towards optimizing inventories and operational capacities. Flexible, automated technologies will maximize the impact of elastic logistics – superior customer service, minimum hidden costs and a highly scalable operating model.

The ability to scale operations in real time through increased distribution channels, prioritized deliveries and efficient robotics-led warehouses will help companies overcome geographic restrictions. By connecting all business processes to centralized cloudbased platforms, agile automated logistics technologies will boost ‘perfect order’ deliveries to improve customer experience and satisfaction.

5. The Model of ‘Everything-as-a-Service’

5. The Model of ‘Everything-as-a-Service’

Logistics will fall into the ‘Everything-as-a-Service’ (XaaS) net as companies approach their products, processes and infrastructure through a services lens to increase efficiencies, optimize costs and unlock new business opportunities. Businesses will increasingly bundle their services on a pay-as-you-use basis such as renting a fleet of warehouse robots, providing realtime monitoring and support services, and back-end data management in the cloud.

For logistics providers, scalability will no longer be a challenge. They will pay for only what they use, and eliminate the risk of huge investments in emerging, untested or expensive technologies. For example, by leveraging Roboticsas- a-Service (RaaS), companies can hire a fleet of robots to handle seasonal peaks without making significant upfront investments.

Amazon is extending services used in its e-commerce operations such as warehouse functionalities, fulfillment and customer service to businesses for a fee.10 The retail giant is also setting up its own shipping business to deliver its parcels and for other retailers to use.11

As new concepts, models and technologies disrupt the business, S&L companies will have to look at partnerships with business process and technology providers to excel in performance and exceed customer expectations.