The rapid adoption of Social Media, Mobility, Analytics and Cloud (SMAC) technology across consumer segments is opening up new opportunities in insurance outsourcing services. Insurance companies are teaming up with insurance BPO partners to:

- Find innovative ways to monitor their brand’s online reputation and social media index

- Actively participate in social conversations

- Provide an interactive customer service interface and monetize it effectively

Social media presents a whole new world of opportunity for insurers. Gradually, social media solutions are becoming an important aspect of insurance BPO services for a number of reasons.

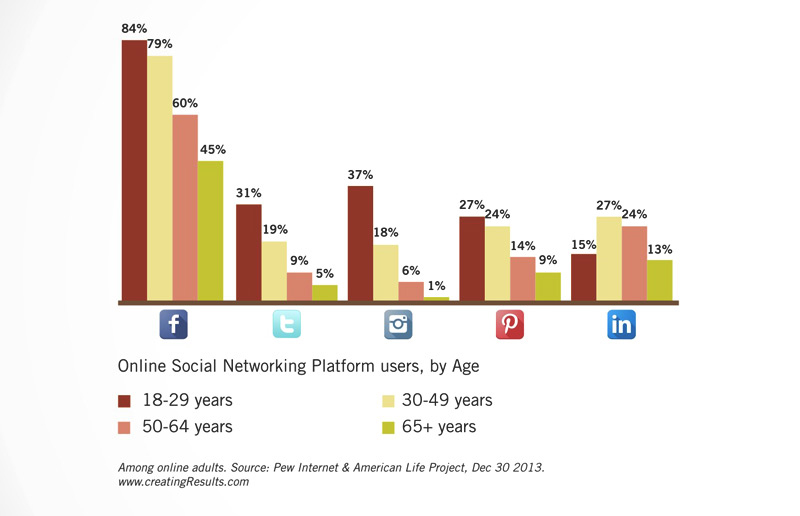

- Customers and prospects prefer non-traditional channels of communication – online chats, and reviews and product ratings posted on social media to learn about insurance products. The table below shows why social media is the right platform to target the young.

- Insurance companies have traditionally functioned through word-of-mouth marketing and client referrals. Endorsements on social media now present an additional opportunity to influence customer behavior.

- Direct engagement of staff to build trust and loyalty and conversion of existing customers into brand advocates to influence potential customers are two effective methods of enhancing brand visibility through social media.

- Insurers can cater to real-time customer queries and complaints, flash alerts on price change, circulate value-added information on insurance covers and provide analytics dashboards for quick and effective decision-making on these forums, thereby reducing contact center effort and costs, and improving customer service.

- Social media analytics can help insurance companies develop customized products, based on customer insights gathered through social conversations, thereby contributing to revenue and market-share.

- The increasing adoption of SMAC and other forms of automation improve underwriting and claims processing, while data analysis of customers’ social networking activities help detect frauds and malpractices.

- Proactive measures can be taken via social media channels to guide customers about new regulations or compliance requirements.

- Social media offers the perfect channel to reach out to the company’s network of agents and brokers with updated information on rates, discounts, and policyrelated matters.

Social media engagement is still at a nascent stage for the insurance business, with many companies venturing into it only now. The real question is how to participate and make the most out of a company’s social media presence.

Some insurance companies have seen early successes in not just the level of engagement that can be measured by ‘likes’ and re-tweets, but also in the way they are creating goodwill by highlighting their corporate social responsibility efforts. A company’s social media strategy may be to educate the masses, create a platform for customer service, to sell, cross-sell or up-sell products, or to create an image of a friendly, caring and approachable brand.

Though USSA is one of the first insurers to move into this space, it’s AllState with its mascot page that seems to have garnered the most attention. On Facebook, MetLife leads the way thanks to its popular Snoopy and Charlie Brown mascots. Liberty Mutual has been rapidly growing its fan base. In Twitter, GEICO is the only brand to have a dedicated support handle.

Social media not only provides insurers with ample opportunities, but it also presents them with new risks and challenges. There are concerns regarding customer privacy, regulatory compliance, core insurance solutions, delivery models and integration of business models. Another concern is the possibility of negative sentiments spreading fast because of a single unfavorable comment or tweet. Companies need to be constantly on top of the situation, take corrective measures in real-time and maintain the brand’s reputation.

Social media has the power to re- shape the insurance outsourcing sector, opening up new opportunities for leadership. However, insurers need to work on its IT infrastructure and legacy policy administration systems. Besides technology capability, a successful social media strategy is about thorough planning and execution. WNS that has a strong track record in insurance outsourcing services recommends the Learn-Analyze-Define process as the basis for a successful social media strategy. In this approach, a company’s existing processes are reviewed, gaps are identified and a new framework and service delivery models are defined. The process makes effective use of analytics to provide added value and quicker ROI. WNS recently helped a leading Australian insurance firm win a coveted national award for the best use of social media.

Insurance companies need robust social media platforms that leverage analytics and enjoy the backing of a strong customer service orientation. This winning formula will help not just improve brand presence but also monetize an insurance company’s social media presence.