What is NDC?

The global airline industry is an economic force multiplier, making a staggering impact of USD 2.4 Trillion when direct, 1 indirect and catalytic effects are included . With the coming New Distribution Capability (NDC) revolution, the industry may finally be able to improve its own prospects by reversing chronic profitability issues.

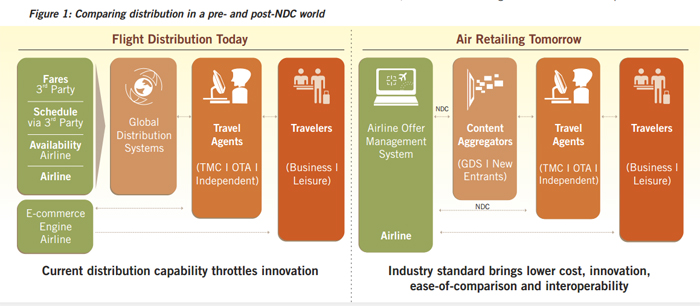

NDC is an International Air Transport Association (IATA)- backed, XML-based data transmission standard that allows carriers to distribute a full range of products through travel agents via greatly improved communications. Significantly from an adoption standpoint, NDC is open to any third-party, intermediary, provider or non-IATA member to implement and use. It promises to give airlines control over the exact product or product suite they offer, at any given point in time, to any given traveller.

Case Study

A Telecom Solutions Player for Air Transport Industry Cuts Unallocated Cash by 50 Percent

Read More

However, capitalizing on the NDC opportunity will require an overhaul of airline business processes and IT systems. Carriers, therefore, need to carefully study the issues that NDC is designed to address, understand the likely costs and benefits, and make an intelligent decision on how to proceed.

The Airline Industry: Grounded until Further Notice?

Once the airline industry pays its suppliers and services its debt, there is virtually nothing left over — with returns on invested capital reported to be an unhealthy 4.1 percent 2 according to the latest research by IATA .

This has made profit improvement and cost reduction urgent imperatives for airlines worldwide. On the cost side, distribution expenses stand second only to expenditure on fuel. Consequently, the industry is exploring ways to drive down distribution costs, including booking fees of approximately USD 4 per flight paid to Global Distribution System (GDS) operators.

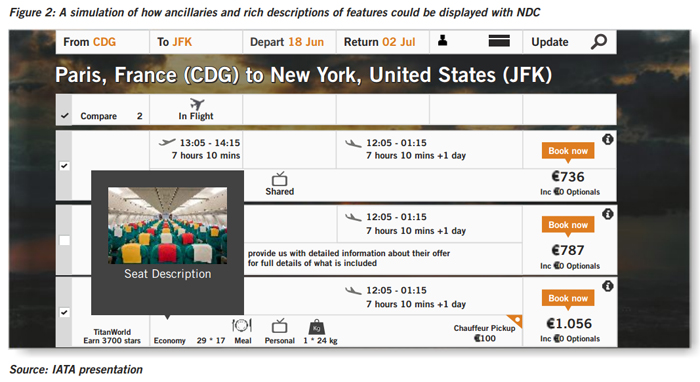

Second, airlines as a whole would be unprofitable without 3 ancillary services and premium fares, so airlines are also laser-focused on increasing sales of add-ons. However, doing this presents a challenge as carriers cannot currently sell their full range of options such as preferred seating, on-board Wi-Fi and in-flight meals through the indirect channel.

Further, the industry faces chronic issues around control of its inventory, which to a significant degree is regulated by intermediaries such as travel agents. In an ideal world, carriers would like to have greater sway over how bookings are made as well as greater transparency in the booking process.

NDC Promises to be a Game Changer

The NDC standard completely transforms the abilities of an airline to serve their customers and drive greater revenue through the indirect channel. With NDC, they can:

- Distribute their entire product portfolio, including ancillaries that account for a growing proportion of revenues and profit

- Offer value-added products and services when applicable, on the basis of personal information, should customers choose to disclose it

- Display far more information on products, including rich descriptions of differentiating facilities with media such as photographs

- Bring new products faster to market and deliver a shopping experience based on customer preferences

WNS's View

Carriers need to get three things right at the outset of any NDC program to ensure they are ready for success. These critical elements are an NDC feasibility study, a robust functional requirement document and the right technology and business process provider.

- NDC feasibility study: Making a wise 'go / no-go' decision

Airlines must carefully study their current distribution model, and analyze direct as well as indirect sales to understand the impact of the indirect channel. They also need to evaluate the current state of their revenue accounting systems and ancillary management by channel, and the contribution of ancillaries to overall sales. Once the study is performed, carriers will be armed with a diagnostic that identifies the areas that need the most attention.

- A robust functional requirement document for IT preparedness

A robust functional requirement document positions a carrier for a smooth implementation and an optimal solution. Alongside airline system details, it is important to ensure that the document lays out a detailed integration plan and a well-defined NDC component mapping based on the airline's NDC strategy. This will ensure that any future NDC implementation is tailored to an airline's specific needs and strategy.

- Engaging the right IT and business process partner

The right technology and business process partner can mean the difference between a well-implemented NDC program and a poorly conceived one that takes up organizational resources without proportionate benefit. Systems integration and migration experience is not enough — carriers must insist on deep airline industry expertise, including verifiable systems and process knowledge from their external collaborators.

With NDC, the airline industry is making bold moves to end its low profitability and commoditization tailspin. While the path ahead is long, carriers need to act today to gain the full benefit of the coming distribution revolution. By positioning themselves correctly, farsighted airlines can outperform not only industry benchmarks but also their competitors.