Dynamic discounting can be powerful enough to become the Holy Grail for reducing the cost of goods sold (COGS). Easier said than done. WNS, a globally leading Business Process Management (BPM) company, outlines the chasm between knowing and realizing the actual benefits.

While 80 percent of companies place a lot of emphasis on capturing early payment discounts, research shows that only 27 percent are able to capture all the discounts available, for various reasons such as:

- Companies may be unable to process invoices fast enough, with a large percentage of paper invoices being past due when they arrive in Accounts Payable (AP)

- Organizations may not be able to conduct the spend analysis necessary to maximize discount capture, including understanding Purchase Order (PO) penetration rates, current terms of payment across suppliers and the prevalence of discount-free early payment

- Companies may not have access to best-in-breed technology platforms to run a high-impact dynamic discounting program, such as a tightly integrated vendor portal and an effective accounts payable automation solution.

The Power of Dynamic Discounting

CFOs are known to extend payables as a protective strategy to preserve working capital and earn interest from surplus cash. With cost of borrowing at record low levels, and excess cash and liquid investments sitting on the balance sheet of companies, far-sighted finance leaders are making every attempt to reduce cost of goods and services with or without leveraging internal cash balances.

Instead of stretching payables, many are now turning to dynamic discounting – a capability that allows companies to pay invoices faster in exchange for discounts, based on a sliding scale. In effect, suppliers can choose to accept early payments against their approved receivables for a variable discount that shrinks as the due date approaches.

Done right, dynamic discounting can enable companies to optimize cash flow and create a win-win relationship with suppliers. As payment terms get extended, and Basel III and other regulations force banks to reserve more capital before lending to small businesses, a segment of the company's suppliers would have a greater need for cash and may be more willing to offer a discount in exchange for payment acceleration. Companies pay suppliers early in return for reduced prices and earn an excellent attractive Annual Percentage Rate (APR). For suppliers, faster payments mean less dependence on borrowing capital; 100 percent factoring, reduced Day Sales Outstanding (DSO), which translates to lower collection costs and higher availability of working capital.

Known, But Unattainable

Adopting dynamic discounting for all its true potential still remains at large because of many reasons.

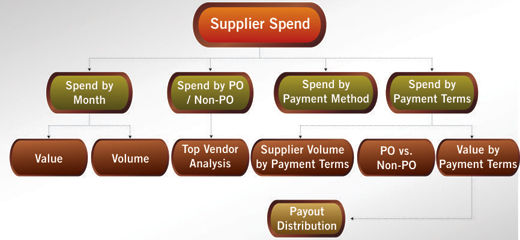

Figure 1. Illustrative spend analytics framework to help define a dynamic discounting strategy

Spend analytics shapes the foundation of a dynamic discounting program:

Without visibility into supplier spends, invoice volumes and payment terms, it is impossible to evaluate the potential of a dynamic discounting initiative or define discount terms that would elicit the greatest response. Figure 1 (above) illustrates the spend analytics framework that helps define a dynamic discounting strategy. The various dimensions of spend analytics basis which a dynamic discounting strategy can be framed are:

- Monthly spends per supplier

- Distribution based on PO / non-PO invoices

- Payment terms as well as method

Based on a structured optimization model built using historical data, the organization can leverage maximum gains through dynamic discounting. The model can be applied according to industry-specific and / or geography-specific suppliers, to negotiate the payment terms and potential discounts.

A well-constructed compressed invoice-to-pay cycle delivers sustainable benefits:

Companies issuing paper-based invoices are people-intensive. Typically, in such a scenario, the overall invoice-to-pay cycle takes 30 to 120 days. With numerous solutions purporting to deliver paperless invoice processing, companies need to identify a pertinent AP automation strategy. Some of the elements to consider are company-specific pain areas, the readiness of suppliers to adopt new ways of working, the capabilities of existing infrastructure and the suitability of different solutions for each supplier category. From a working capital standpoint, it is best to take an 'all-in' approach and drive the highest possible level in AP automation with e-invoicing, electronic data interchange, evaluated receipt settlement, integrated Purchase-to-Pay (P2P) processing and self-service supplier portals. A compressed invoice-to-pay cycle helps in capturing maximum discount.

The right technology platform can help deliver projected impact:

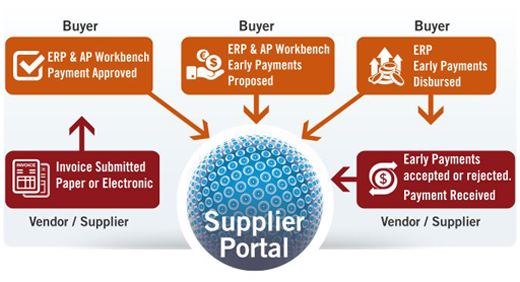

An enterprise which is serious about pursuing AP automation and dynamic discounting should evaluate vendors basis the capability of the solution to mitigate delays in invoice approvals, provide visibility into invoices in multiple formats from different sources, eliminate or reduce manual processes enabling greater focus on exceptions, and manage the non-PO invoice-led errors. Vendor portal effectiveness is another crucial determinant of dynamic discounting success, due to the need for smooth vendor supplier communication and integration with AP automation initiatives. The vendor portal should facilitate exchange of all types of documents electronically, without having to incur additional transaction costs. Most important, it must have built-in dynamic discount management functionalities.

Net-net – The Bottom-line

Stretching net payment terms and providing sliding scale discounts past the standard discount date dramatically expands the early-payment-discount opportunity. Companies seeking sizeable improvement in financial metrics through dynamic discounting should combine spend analytics with compressed invoice-to-pay cycle and best-in-class P2P technology. By gaining insights into where money is spent, implementing a touchless AP process, and driving vendor collaboration and discount capture via a dedicated supplier portal, CFOs can optimize the finance supply chain and fulfill their role as a true business partner.

Figure 2: Dynamic discounting using vendor portal

First published in the winter 2014 edition of Finance Director Europe