Driving healthier cash flows and better customer relationships with lower revenue leakage — at lower cost.

A Multibillion Dollar Untapped Opportunity

The Business-to-Business (B2B) collections function performs a crucial role in safeguarding the health of the cash conversion cycle, especially in times of economic uncertainty. However, its activities must be handled with care to avoid impacting otherwise profitable customer relationships.

The collections function is in the spotlight today because of renewed focus on cash flow and revenue assurance. WNS's research shows that a one-day improvement in days-to-receive could unlock as much as USD 8.6 Billion in cash in the case of automotive industry (for players with annual revenues in excess of USD 500 Million). Revenue leakage is another key issue that collectors can work to diminish, keeping in mind that companies lose up to 15 percent of revenue to customer 1 deductions each year . This begs the question: if the business impact of a better performing collections function is so compelling, why aren't organizations turning collections challenges into cash flow and revenue assurance opportunities?

Case Study

A Leading Utility Increases its Debt Collection by 50 Percent with Predictive Analytics

Read More

End-to-End Predictive Analytics Embedded in a Proven Methodology is a Collector's Best Friend

The route to optimized collections is through the adoption of a predictive analytics approach applied throughout the collections lifecycle and a proven methodology that encompasses 'data to deployment.'

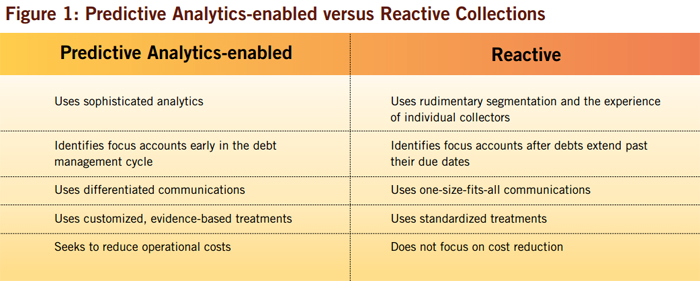

The candid answer is that they are unable to make breakthrough improvements in performance through operational excellence alone. Consider the workings of a typical organization. Often, a collections team begins by extracting a bad debt report from the ERP; then uses agebased categories to segregate debt and assigns them to collectors based on their experience. This approach suffers from two critical shortcomings:

It is a reactive approach that makes no effort to understand the causes of delinquency and prevent delayed payments before they occur

It fails to take advantage of the advances in predictive analytics that have already transformed Business-to- Consumer (B2C) collections in industries such as payment cards and utilities

The conventional approach is also over-reliant on collector experience to drive effectiveness. As a result of these deficiencies, companies spend resources inefficiently and without adequate gain. This shows up as higher costs, lower customer satisfaction and lack of visibility into cash flow, revenue and risk. In the most critical cases, companies may experience a swelling of the portfolio of receivables more than 90 days past due and a low debt recovery rate.

The right approach uses forward-looking analytics to address both the 'what' and the 'how' of collections to guide customized and proactive treatments. In other words, it allows agents to pursue the right debts and customers, using the right treatments — for maximum effectiveness with minimum effort.

Predictive analytics is valuable not only during collections activities, but also in preceding and following stages. Prior to collections, analysis of past and present payments (such as balance amounts and payments in the end-credit period) can materially reduce the incidence of bad debt. During collections, analytics can help on two fronts: Pre-contact through elements like customer prioritization; and postcontact through customized settlement treatments.

Companies can also tailor customer communications and offer self-service options based on analytics-driven insights. Post collections, analytics can help continually adjust collections strategy in line with a changing environment, such as spotlighting the products and accounts that require closer attention.

Perhaps the most important contribution of predictive analytics is in the development of a dynamic propensity-topay model, with each customer scored on elements such as past payment pattern, value of debt, location and product purchased. This identifies high-risk accounts, along with forecasting the most effective treatment for each account. When done right, the model enables collectors to contact the right customer at the right time; with the right messaging and most effective payment options. It also helps collectors focus attention away from accounts that do not need attention — such as those shown to consistently self-heal soon after the due date.

For a provider of IT and communication services to the air transport industry, profiling debt on the basis of outstanding periods and amounts helped uncover customers who held up the greatest quantum of cash and were the slowest to pay. This enabled the client to restrict sales or terms of payment in a targeted way. As part of a larger process transformation conducted by WNS, the initiative delivered more than USD 176 Million in business impact over five years, and allowed the customer to scale down its provision for bad debts.

The second pillar of a predictive analytics-based approach is a well-defined 'data to deployment' methodology. Without a proven process, businesses cannot fully extract value from their data, or equip their collections teams with actionable insights. Organizations must follow three steps to close the gap between raw data and eventual model deployment and usage.

- Data preparation and profiling: First, enterprises need to gain insight into the characteristics of a dataset and identify the breakdown of metrics such as Days Sales Outstanding (DSO), best possible DSO, delinquent DSO, bad debt to sales, and cost of finance as a percentage of sales across customer segments. Then they need to identify the predictors of debtor behavior to build a propensity-topay model. For example, there may be a customer who habitually makes part payments; but responds well to a particular account treatment plan.

- Data modeling: Next, a variety of data models (such as logistic regression and multi-layer neural network) must be instituted to visualize data profiles. Techniques like decision trees can be used to display segments for easy identification of debtor categories.

- Model deployment: Once the optimal model is found, key performance indicators must be chosen; and customers appropriately segmented. If necessary, the model can be integrated with existing accounts receivable or account management software that the organization may be using for a simplified workflow and easier self-service visualization.

While the potential impact varies across industries, consider this: listed medical device and equipment manufacturers with revenues of more than USD 500 Million would add USD 450 Million to their pre-tax bottom line if they reduced bad debt expenses and charge-offs by a modest 0.5 percentage points. At minimum, an analytics-enabled collections process increases the Collection Effectiveness Index (CEI) which, in turn, drives down DSO for cash flow improvement. It also reduces the cost of customer support operations, and improves risk management and customer satisfaction. Equally significant, such a process stems revenue leakage and reduces account write-offs.

As predictive analytics transforms every aspect of business in a data-rich world, organizations stand to gain a major advantage by embracing its potential for debt collection. As an increasing number of B2B companies are learning, this is the foundation of a next-generation collections function.