They are serious, chronically and progressively disabling, and can be life-limiting and life-threatening. According to the U.S. National Organization for Rare Disorders (NORD),1 there are close to 7,000 notified rare diseases.2 Although there is no consensus on the definition of rare disease, many geographies define it predominantly on the basis of their prevalence. Others classify them based on the severity of the disease and the availability of alternate options for treatment.

Pharmaceutical products aimed at treating rare diseases or disorders are called orphan drugs. The Orphan Drug Act of 1983 was the first U.S. initiative to facilitate and incentivize the development of drugs to treat rare diseases.3 The success of the Orphan Drug Act of 1983 in the U.S. led to its adoption in other key markets.

Notable among them were Japan (Article 77-2 of the Pharmaceutical Affairs Law-1993)4 and the European Union (the EU Regulation on Orphan Medicinal Products- 1999).5

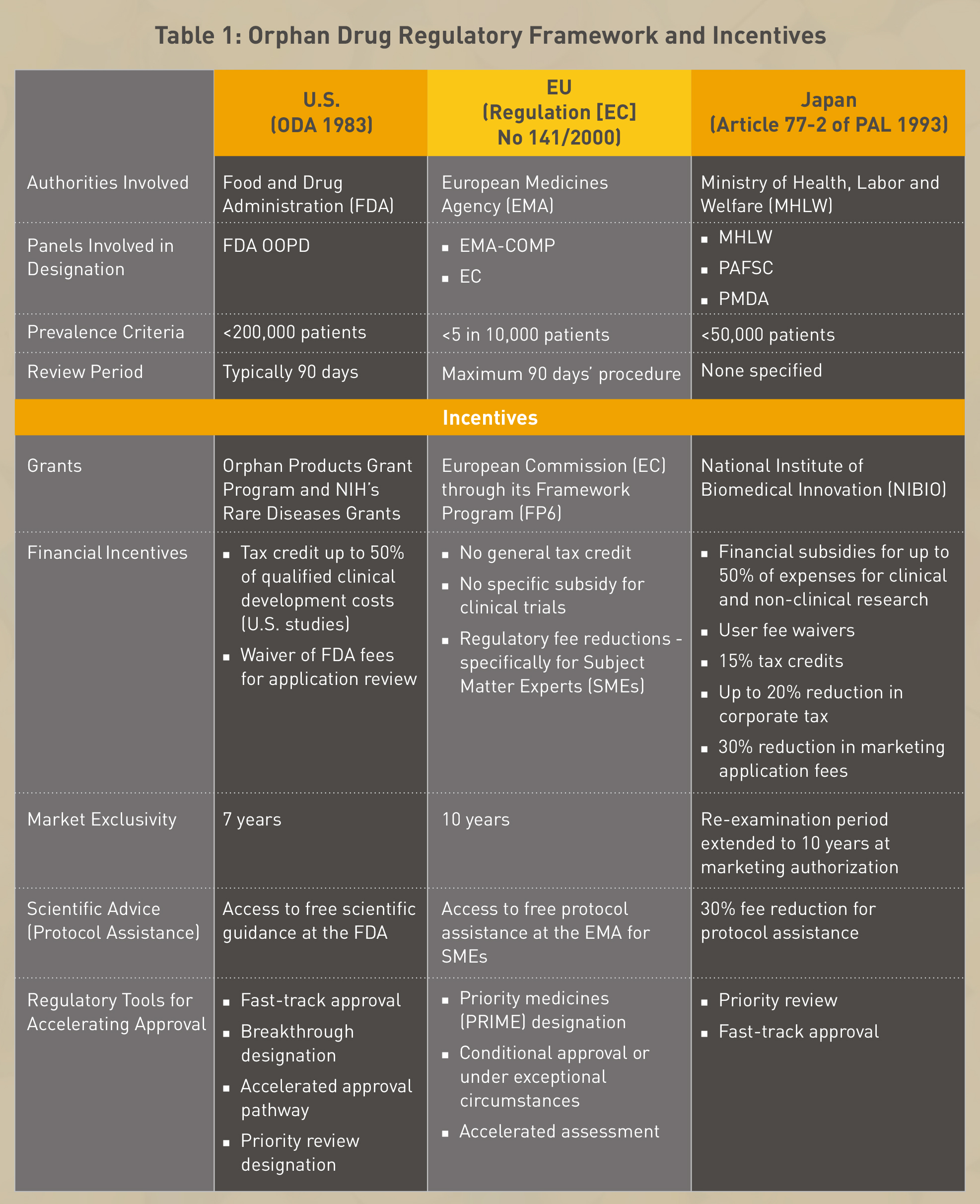

The key features of the orphan drug regulatory framework in the USA, EU and Japan are summarized as shown in Table 1.

Till date the U.S. Food and Drug Administration (FDA) has approved 628 orphan drugs and biological products for rare diseases. When compared to fewer than 10 products that were approved in the decade before the Act was passed,6 the efficacy and success of the Orphan Drug Act (1983) becomes evident. The European Commission has authorized 137 orphan medicines to benefit patients suffering from rare diseases since the inception of their regulation.7

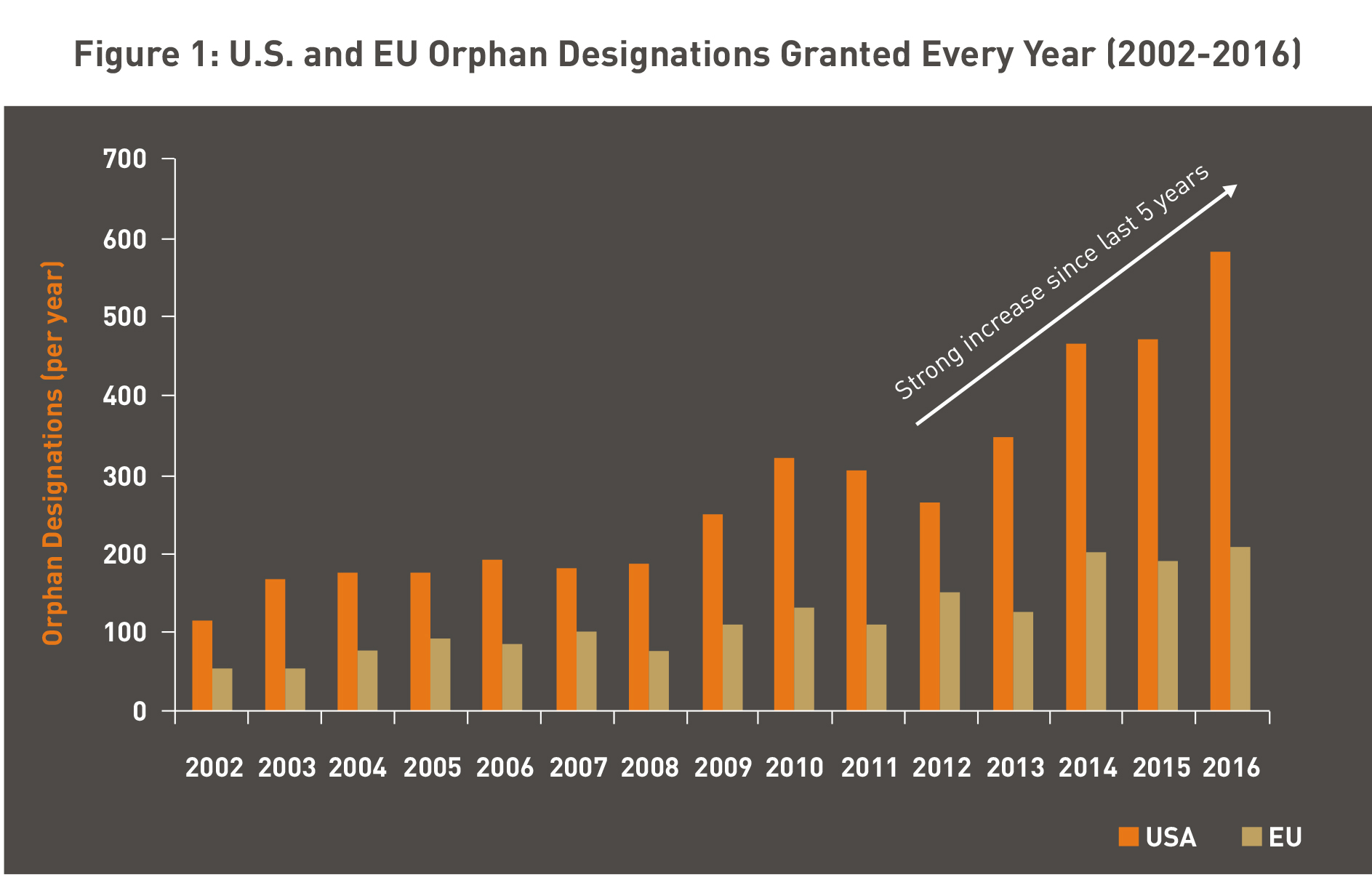

The increase in the number of Orphan Drug Designation (ODD) granted in the last five years, both in the U.S. and EU indicates the increasing interest of the pharma industry in developing orphan drugs (Figure 1).

Sources: FDA Application: https://www.accessdata.fda.gov/scripts/opdlisting/oopd/index.cfm

Orphanet (European portal for rare diseases and orphan drugs): http://www.orpha.net

Pharma Interest in Orphan Drugs

The development of orphan drugs opens the door for potential commercial opportunities for pharma companies. A sluggish prescription drug market in both U.S. and Europe regions makes orphan drug development an attractive proposition. Driven by increasing regulatory challenges and high costs of getting a mass-market drug approved, the pharma industry has been moving from ‘blockbuster models’ to ‘niche-buster’ opportunities.

Besides financial incentives (that include tax incentive for certain Research and Development, and clinical development costs), waiver of regulatory application fees and extended market exclusivity through monopoly protection, there are a few more factors that add to the commercial appeal for orphan drug development. Legal frameworks provide a fast-tracked regulatory review and approval process for orphan drugs. Low manufacturing costs, scientific breakthroughs and stronger advocacy through increased coordination between doctors and patient groups have also helped.

The orphan drug market has thus become a profitable opportunity for companies who are willing to invest in the rare disease space. According to a recent report by EvaluatePharma, the worldwide sales of orphan drugs is expected to touch USD 209 Billion by 2022. This is a doubling of sales between 2016 and 2022, with a CAGR of +11.1 percent for the period 2017- 2022.8 Notably, the report says orphan drugs are expected to touch 21.4 percent of worldwide prescription sales by 2022 (excluding generics).

Unique Challenges in Orphan Drug Development

Increased licensing for the development of orphan drugs is opening the gates to greater competition and changing the market dynamics. The orphan drug market is now beginning to show trends seen in traditional pharma markets. Additionally, the development of orphan drugs is faced with the following challenges that are unique to rare diseases:

-

Huge heterogeneity in disease pathophysiology, and poorly understood natural histories of disease progression

-

Geographic dispersion of patients that lead to their limited availability for clinical trials

-

Lack of previous clinical studies to establish a template for study execution (this leads to uncertainties in applying appropriate end points and duration for treatment)

-

Heterogeneity in treatment effects, and complexity of statistical analysis associated with limited sample sizes

-

Lack of knowledge in appropriate biomarkers to predict outcomes

-

Limited number of experienced clinical investigators worldwide

-

Absence of regulatory precedents and harmonization of the approval process between different national agencies

-

Unclear post-market commitments that impact long- term risk-benefit studies

-

Changing payer demands in rare disease cases where multiple treatment options are now available

Despite the challenges, creative Competitive Intelligence (CI) strategies can provide a focused and optimized approach for the successful development of orphan drugs.

Effective CI Strategies for Orphan Drug Development

CI can provide actionable corporate intelligence and global competitive landscape analysis to enable superior pharma strategies. When properly executed, CI unravels invaluable assumptions and insights on pharmaceutical competitors' capabilities, current strategy and future goals. CI strategies help gather primary and secondary intelligence without any internal bias, effectively aggregate them to connect the dots and have a global view of the competitive landscape to identify opportunities and threats.

CI can play a significant role in objectively providing better drug development strategies. By analyzing the past and modeling the future it can:

-

Provide trends, and anticipated responses of regulatory authorities and payers to outcomes of new initiatives

-

Identify the changing standards of care that need to be adapted

-

Analyze the market response to new agents

-

Predict 'most likely' competitor scenarios

While no two rare disease areas can be tackled with a set template of CI strategy, an arsenal of previously acquired knowledge base can be leveraged for efficient analysis of complex scenarios. This can enable the successful development of orphan drugs.

Conclusion

Rare diseases provide significant opportunities to the pharmaceutical industry. However, clinical and regulatory challenges, and unique market dynamics for reimbursements have a significant impact on the development and commercialization of orphan drugs. CI strategies and tools can be valuable assets in assisting the development of orphan drugs. However, they will need to be tailored to specific rare disease environments and deployed with ingenuity to provide meaningful outcomes.