" If you want to be a millionaire, start with a billion dollars and launch a new airline. "

- Richard Branson, Founder, Virgin Group

Who can sum up the inherently challenging nature of the airline business better than the maverick founder of Virgin Atlantic? However, in the last few years, airlines seem to have reined in the challenges to some extent. They continue to expand their top-line and bottom-line at a healthy pace, by overcoming the barriers posed by growing competition, rising fuel prices, changing regulatory norms and rapidly evolving passenger expectations.

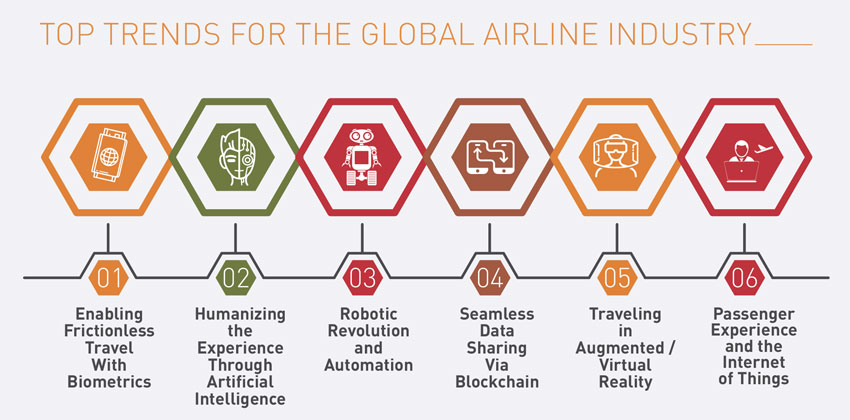

The International Air Transport Association (IATA)1 forecasts the sector's net profit to rise to USD 38.4 Billion in 2018 making this the fourth consecutive year of sustainable profits. As airlines pursue wider market share, and adopt new technologies to re-imagine their offerings and operations, here are six technology trends that will have a significant impact on their business outcomes.

Trend 1: Enabling Frictionless Travel With Biometrics

Trend 1: Enabling Frictionless Travel With Biometrics

The adoption of biometrics is still at a nascent stage in the industry. But a few airlines have already begun investing in fingerprint and facial recognition technology. Currently, the technology is being tested in areas such as check-in, security, lounge access and boarding.

Long queues for security check or at the baggage carousel continue to be the foremost pain point for passengers. Also, having to constantly show their passports, identity cards or boarding passes for verification add to their frustrations. Airlines are increasingly experimenting with biometrics to address these issues and make the journey as frictionless as possible for passengers.

In the long run, paper and mobile boarding passes will become obsolete as airlines use facial, iris or fingerprint scans to identify passengers. A European airline has already piloted facial-recognition programs to reduce check-in and boarding time. The U.S. Transportation Security Administration (TSA) has unveiled an initiative across 30 domestic airports to use passengers' fingerprints for identification and issuing boarding passes.

If the associated privacy concerns around data are addressed by airlines, biometrics will deliver multiple benefits including shorter waiting time for passengers.

Trend 2: Humanizing the Experience Through Artificial Intelligence

Trend 2: Humanizing the Experience Through Artificial Intelligence

Globally, the market for Artificial Intelligence (AI) in airlines is expected to touch USD 2.2 Billion by 2025.2 Different use cases for AI adoption across the industry are gradually taking shape. The most common one, of course, are chatbots that are becoming increasingly sophisticated in resolving passenger queries.

Some airlines are looking beyond chatbots to leverage the true potential of AI. For example, a leading Asian airline is using AI to estimate the average lifespan of the parts on its planes. The airline has been able to quicken inspections, optimize the inventory for parts and improve operational efficiency. Airlines are also using AI and predictive analytics to create personalized promotional campaigns to improve upsell / cross-sell opportunities. Airline revenue management is another area where AI and machine learning are expected to drive transformation in the long term.

Trend 3: Robotic Revolution and Automation

Trend 3: Robotic Revolution and Automation

Over the next decade, the global robotics and automation market is expected to touch USD 1.2 Trillion.3 The airline industry is expected to make up a significant chunk of this rapidly growing market. Automation of workflows has been a major focus area for the industry in recent years. And, this focus is only accelerating with the early-stage adoption of robots.

For instance, a Korean airport has tied up with a leading electronics company to test two prototype robots that will deliver boarding information and directions to passengers. A global IT company that offers services to the air transport industry has designed an intelligent check-in kiosk that can autonomously move to congested areas of the airport to reduce the waiting time for passengers.4 Robots at a Japanese airport, meanwhile, are automating several tasks including flagging security risks and transporting luggage.

Trend 4: Seamless Data Sharing Via Blockchain

Trend 4: Seamless Data Sharing Via Blockchain

The airline industry is characterized by data sharing among multiple players across the entire value chain. At every touchpoint of the passengers' journeys, complex data reconciliations happen in the background. However, given airlines' siloed systems for storing data, this data exchange is rarely seamless. This is one area where blockchain — often referred to as the 'Internet of Trust' — can enable airlines to conduct smoother data sharing and eliminate multiple transaction costs.

Often, in the event of flight delays, passengers get inaccurate status updates. Blockchain's inherent ability to provide a single source of truth can help airlines provide accurate flight updates in real time across multiple channels during delays.

A prominent German airline has formed an alliance with many companies to explore blockchain-centric distribution, while other airlines are figuring out use cases for retail, distribution and baggage handling. A leading South Asian airline has launched a blockchain-based loyalty wallet that allows members to redeem airline miles at point-of-sale.

Trend 5: Traveling in Augmented / Virtual Reality

Trend 5: Traveling in Augmented / Virtual Reality

The excitement around Augmented Reality (AR) and Virtual Reality (VR) cuts across industries — market research firm IDC pegs the worldwide revenue from AR / VR at USD 162 Billion by 2020.5 Airlines are also exploring different implementation scenarios for AR and VR ranging from airport wayfinding to remote airport operational control centers to immersive in-flight entertainment.

Gatwick airport in the U.K., for instance, has launched a beacon-based AR wayfinding tool that shows direction to passengers through their mobile phone cameras.6 The AR tool makes it easier for passengers to navigate within the terminal and locate check-in desks, departure gates and baggage carousels.

Passengers aboard Airbus A380 flights are using the AR-led iOS app iflyA3807 to take 360-degree virtual tours of the cabin, have a closer look inside the cockpit or to know more about landmarks they are flying over. At New York's JFK airport, passengers waiting for budget flights are given VR headsets by a European airline to 'show' them its competing offerings for upselling opportunities.

With increasing adoption, airline mechanics will most likely use AR to carry out quick, accurate repairs and maintenance that can be signed off remotely by supervisors. This improvement in efficiency and accuracy will translate into faster repairs, minimal equipment breakdowns and fewer delayed flights for airlines.

Trend 6: Passenger Experience and the Internet of Things

Trend 6: Passenger Experience and the Internet of Things

Though airlines are still struggling to bring their legacy systems up-to-speed, many have rolled out Internet of Things (IoT) initiatives to re-define the passenger experience. Airlines are looking at leveraging IoT for operational areas ranging from baggage management to in-flight entertainment.

A leading U.S. airline has invested millions of dollars for the deployment of IoT to track baggage in real time thereby improving both reliability and transparency. Airlines are also offering personalized navigation at airports by integrating their native mobile apps with airports' beacons. As passengers move across terminals, their locations can be used to guide them toward departure gates, push customized offers, or direct them to lounges at discounted rates.

IoT combined with advanced analytics can also open up several upsell / cross-sell opportunities for airlines. Historical data around passengers' preferences can be used to make personalized in-flight offers such as upgrades. Curated entertainment content can also be made available with all charges seamlessly debited from digital payment accounts.

Looking Ahead

Looking Ahead

As digital technologies continue to transform the industry and re-shape consumer expectations, airlines will have to regularly re-visit their core operating assumptions to stay relevant. They will have to re-imagine key operations and functions to deliver compelling and differentiated passenger experience. With the 'consumerization' wave transforming many service sectors including media, transportation and retail, airlines too will have to harness cutting-edge technologies in a 'smart' way. They will have to aggressively experiment with different use cases to address pressing passenger pain points and use the learnings to continuously refine their approach.

Click here to view the infographic

Forward-thinking airlines are increasingly leveraging emerging travel technology trends to power their digital transformation efforts and deliver exceptional customer experiences.