U.K.-based mobile-only bank, Monzo, has tied up with automation platform If This Then That (IFTTT) to help customers manage their personal finances.1 By using applets — pre-defined rules — customers can, for instance, ask Google Assistant to “save five pounds,” and the amount will be automatically saved. Customers can create their own applets or download Monzo’s pre-made applets.

Such examples highlight the rising dominance of new technologies re-defining the banking and financial services landscape. Let us delve into some of the key trends transforming retail banking, and the moves being made by traditional banks to stay relevant.

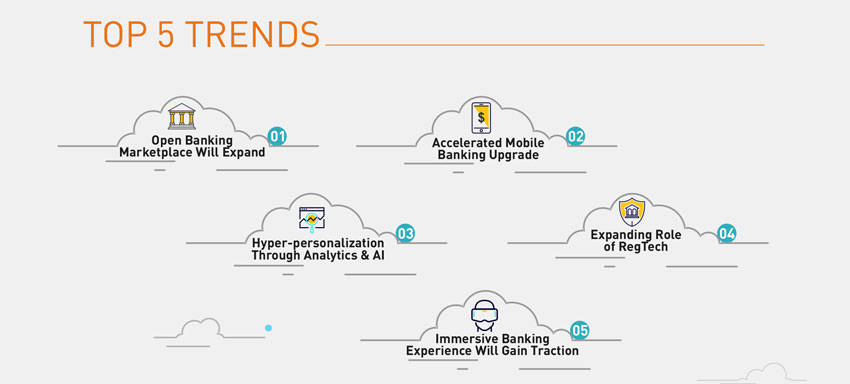

1. Open Banking Marketplace Will Expand

1. Open Banking Marketplace Will Expand

With Europe’s Payment Services Directive II (PSD2) coming into effect from January 2018, the FinTech disruption in banking is now absolute. Non-banking service providers now have the same level of access as banks to customers’ transactional behaviors as well as risk histories.

This has taken away banks’ often monopolistic position in designing one-size-fits-all products and services for customers. FinTech offerings, shaped by current market demands and technological expertise, are more diverse and personalized.

The digital financial services marketplace, FinanceBay,2 is positioning itself as a one-stop-shop for curated apps and services in banking, financial management, insurance as well as stock market trading. For consumers, this is a convenient and secure aggregation of apps they can use to make their lives easier. FinanceBay also has an offering for banks and financial institutions to leapfrog their way into the open banking space by branding and launching a customized marketplace for their own customers.

Bundled with multiple subscription-based revenue models and data analytics capabilities, there will be more instances of FinTech disruptors functioning as partners and collaborators to help banks compete in the open market.

2. Accelerated Mobile Banking Upgrade

2. Accelerated Mobile Banking Upgrade

The mobile phone continues to lead the digital banking experience. The emergence of banks such as Monzo has shown that simplicity of offerings, transparency of information and ease of use are the primary reasons for customers moving away from traditional banks.

Traditional banks are now doubling their efforts to move beyond the token, basic functionality in their apps to bring in greater innovation. Their overarching goal is to drive growth in the number of app users as well as transactions.

Banking mobile apps are currently in the next phase of evolution. They are enabling access to more complex offerings such as mortgages, biometric authentication, digital checks and peer-to-peer payments on mobile. Banks are also able to drive greater personalization through apps by marketing their products and value-added services.

For example, the U.K.-based app-only bank Revolut’s suite of financial products comprises personal loans, cryptocurrencies and small business banking. The bank is in the process of launching a robo-advice product along with commission-free stock trading.3

3. Hyper-personalization Through Analytics & AI

3. Hyper-personalization Through Analytics & AI

From being extensively used to drive intelligent automation in middle and back-office processes, Artificial Intelligence (AI) is now finding greater play in customer-facing functions, especially as the means to drive greater personalization across touch points. From robo-advisors and biometric authentication to voice-activated banking, AI is enabling banks to up their game in personalization.

Various studies have highlighted the linkage between personalized banking experiences and customer loyalty – and this is where banks will have to focus their AI efforts next. Banks are also beginning to leverage analytics to drive hyper-personalization in the form of Next Best Product (NBP) offerings and customized product bundles based on customers’ financial history and requirements, and personalized risk assessments.

The use of connected technologies such as wearables and beacons in conjunction with AI is also being used to deliver personalization in transactions and for visits to branches.

4. Expanding Role of RegTech

4. Expanding Role of RegTech

Regulatory Technology (RegTech) has been playing an increasingly important role in the new banking and financial services ecosystem. Regulations are evolving significantly to keep pace with the changing nature of offerings as well as threats. In this context, RegTech has been an important aggregator of technology capabilities that can help banks and financial institutions keep up with the disruptions.

Leveraging the power of big data, advanced analytics and machine learning, RegTech brings significant advantages to banks through real-time risk management, threat modeling and automated compliance procedures.

On the one hand, regulations such as the Markets in Financial Instruments Directive (MiFID II) and General Data Protection Regulation (GDPR) are being ratified to inject more transparency and protect privacy. On the other, existing norms for Know Your Customer (KYC) and Anti-money Laundering (AML) are being upgraded everywhere. Banks are going to leverage RegTech to a far greater degree to ensure compliance without compromising on either operational efficiency or customer experience.

5. Immersive Banking Experience Will Gain Traction

5. Immersive Banking Experience Will Gain Traction

A more recent trend is the use of Augmented Reality (AR) and Virtual Reality (VR) technologies by banks and financial institutions to help enhance customers’ understanding of and comfort with financial products and services. Several leading banks are exploring the benefits of presenting complex financial data and concepts in a more visual manner.

AR is being used to help customers locate ATMs, branch locations, services and deals in a more engaging manner on their mobiles. VR use cases are primarily around the visualization of investment or wealth portfolio information, along with gamified tools that allow users to drill down for further information or consult with AI avatars. AR and VR are also being explored for customer onboarding as well as educational capsules to create more awareness for more complex offerings.

New Banking Frontiers

The new banking experience is all about enabling personalization and seamless, secure access across all customer transactions that are remotely connected to banking. Banks should focus more on value-added services that put the customer in the driver’s seat. They have to move away from price-based competition to highlight niche areas such as advisory and financial risk management. They have to make aggressive investments in strategic RegTech that will help maintain operational margins while ensuring compliance. These strategies will help banks stay relevant in the new ecosystem in which heightened customercentricity is the key to success.